Food and beverage maker Pepsico, Inc. (NYSE: PEP) reported a lower than anticipated fiscal 2017 third-quarter revenue last week.

Food and beverage maker Pepsico, Inc. (NYSE: PEP) reported a lower than anticipated fiscal 2017 third-quarter revenue last week.

However, the company’s earnings surpassed analysts’ estimates. Pepsico also trimmed its FY17 outlook. Still, on the basis of the details provided underneath, we anticipate a rally in the stock, which ended Friday’s trading session at $110.40.

The makers of Tropicana, Frito Lay, and Quaker Oats reported third-quarter revenue of $16.240 billion, up $213 million from $16.027 billion in the corresponding quarter last year.

Net income for the quarter ended August 2017 increased 8% to $2.144 billion, or $1.49 per share, from $1.992 billion, or $1.37 per share, in the same period last year. Excluding charges, Pepsico recorded Q3 2017 net income of $2.134 billion, or $1.48 per share, compared with $2.036 billion, or $1.40 per share last year. Analysts surveyed by Zacks had expected earnings of $1.43 per share on revenues of $16.31 billion.

PepsiCo

Region wise, Latin America revenues increased 6% y-o-y to $1.873 billion. The Europe, Sub-Saharan Africa revenues grew 8% y-o-y to $3.098 billion. However, Asia, Middle East, and North Africa revenues declined 4% y-o-y to $1.567 billion. In North America, Frito-lay generated revenues of $3.792 billion, up 3% from $3.676 billion in 3Q16. However, it was more than offset by a 3% decline in Beverages revenue to $5.33 billion. Quaker foods generated revenues of $578 million, up 1% on y-o-y basis.

Pepsico said that it now expects a revenue growth of only 2.3% in fiscal 2017, versus prior estimate of at least 3%. Lower Q3 beverage sales in North America, was the main reason for the downward revision of revenue outlook. However, the core EPS outlook for fiscal 2017 was revised upwards to $5.23, from the prior estimate of $5.13. The company reaffirmed its guidance for cash flow from operating activities of $10 billion and free cash flow of $7 billion in fiscal 2017.

Pepsi stated that a shift in media spending, lower sales of sports drink Gatorade, and changes in shelf space allocation was responsible for the weak performance. That keeps the stock bearish. However, the Purchase, New York-based company has clarified that the decline is only temporary after two consecutive years of robust third-quarter performance. Thus, we can soon expect a reversal in the share price.

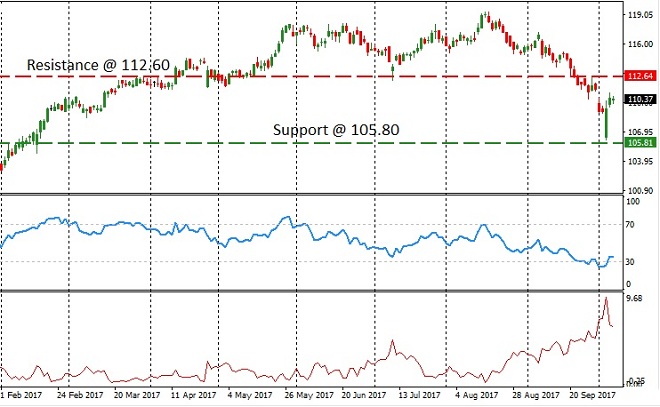

As the image below indicates, the stock has bounced off the support at 105.50. The RSI indicator is rising out of the oversold territory. The William VIX Fix has fallen from the recent high. That confirms an end to the downtrend. Thus, we can expect a short-term bullish reversal in the stock. The next immediate technical resistance for the stock is at 112.50.

To gain from the bullish reversal, we wish to invest in a call option valid for a week. A strike price of about 110 would minimize the risk involved in the trade.